Municipals were little changed Tuesday outside of bumps on the front end, as U.S. Treasury yields rose slightly and equities ended mixed.

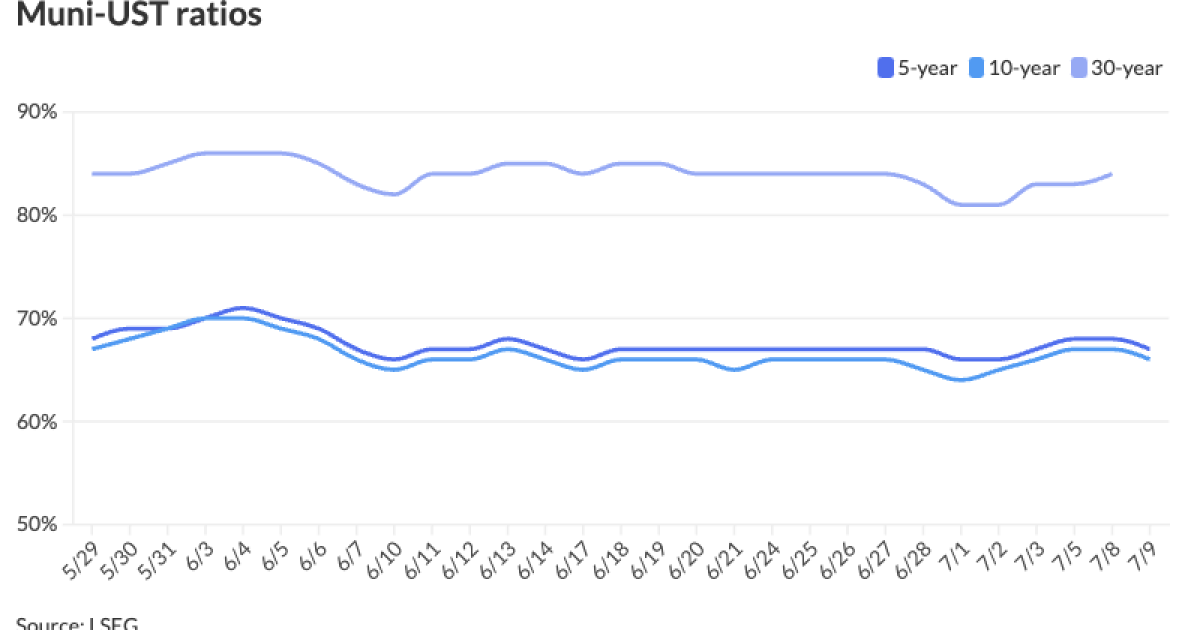

The two-year muni-to-Treasury ratio Tuesday was at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 66% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 67% and the 30-year at 83% at 3:30 p.m.

The previous week was characterized by “limited” new issue supply, leading to a “focus on secondary positions and a decline in dealer balance sheets,” said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

Issuance stands above $9 billion this week as the market returns to an “above-average supply environment,” he said.

The start of the year’s second half usually sees a “favorable” supply/demand imbalance, with

July and August comprise the “strongest” two-month period of the year, he noted.

Muni prices have been “sufficient and mostly steady” despite supply and uncertainty, Fabian said.

Underwriter price concessions are responsible for “placing new issue supply at or close to a record pace,” Fabian said.

As such, muni-offered levels are “comparatively oversold” compared to MMA’s consensus, he noted.

Fabian cautioned buyers: “[Although] this suggests a fairly strong opportunity for near-term gains, more caution is of course warranted at the long end (16 years and longer) where demand is shallower and less consistent.”

Overall, though, demand is “high,” an ongoing tailwind for munis, along with solid fundamentals, said Nuveen strategists.

As 2024 continues, they expect “short-term rates to fall slightly and the municipal yield curve to steepen — this speaks to the benefit of adopting a longer duration for munis.”

“Even without the prospect of a tailwind from a shifting rates environment, municipal bond yields are historically high, meaning current income should help generate attractive returns even without declining rates or spread compression,” they said.

Theoretically, “issuers may want to wait for yields to come a bit lower, but election-related risks are powerful enough to ignore all that and just come to market as soon as possible,” Fabian said.

In the primary market Tuesday, BofA Securities priced for the Washington Metropolitan Area Transit Authority (/AA//AA/)

J.P. Morgan priced for the California Earthquake Authority $250 million of taxable revenue bonds, Series 2024A, with 5.75s of 11/2024 at par, noncall.

BofA Securities priced for Tallahassee, Florida, (/AA/AA+/) $182.08 million of consolidated utility systems refunding revenue bonds, Series 2024A, with 5s of 10/2025 at 3.14%, 5s of 2029 at 2.97%, 5s of 2034 at 3.09%, 5s of 2039 at 3.32% and 5s of 2040 at 3.46%, callable 10/1/2034.

BofA priced for Honolulu (/AA+/AA+/) $169.65 million of GOs. The first tranche, $116.27 million of Series 2024A, saw 5s of 7/2026 at 3.11%, 5s of 2029 at 2.97%, 5s of 2034 at 3.06%, 5.25s of 2039 at 3.30%, 5.25s of 2044 at 3.69% and 5.25s of 2049 at 3.90%, callable 7/1/2034.

The second tranche, $18.485 million of Series 2024B, saw 5s of 7/2025 at 3.15%, 5s of 2029 at 2.97% and 5s of 2032 at 3.03%, noncall.

The third tranche, $9.775 million of Honolulu Rail Transit Project bonds, Series 2024C, saw 5s of 7/2026 at 3.11%, 5s of 2029 at 2.97%, 5s of 2034 at 3.06%, 4s of 2039 at 3.73%, 4s of 2044 at 4.12% and 4.125s of 2049 at 4.32%, callable 7/1/2034.

The fourth tranche, $25.12 million of taxables, Series 2024D, saw all bonds price at par: 4.95s of 7/2025, 4.67s of 2029, 4.87s of 2034 and 5.125s of 2039, callable 7/1/2034.

In the competitive market, Seattle (Aa2/AA//) sold $202.81 million of municipal light and power improvement and refunding revenue bonds, Series 2024, to Jefferies, with 5s of 10/2030 at 2.98%, 5s of 2034 at 3.00%, 5s of 2039 at 3.29%, 5s of 2044 at 3.65%, 5s of 2049 at 3.89% and 5s of 2054 at 4.02%, callable 10/1/2034.

Baltimore County (Aaa/AAA/AAA/) sold $45 million of Metropolitan District bonds, 85th Issue, to BofA Securities, with 5s of 7/2025 at 3.04%, 5s of 2029 at 2.91%, 5s of 2034 at 2.93%, 5s of 2039 at 3.24%, 5s of 2044 at 3.60%, 5s of 2049 at 3.85% and 5s of 2054 at 3.93%, callable 7/1/2034.

The county also sold $114 million of consolidated public improvement bonds, 2024 Series, to BofA, with 5s of 7/2025 at 3.04%, 5s of 2029 at 2.91%, 5s of 2034 at 2.93%, 5s of 2039 at 3.24% and 5s of 2044 at 3.60%, callable 7/1/2034.

Additionally, Baltimore County sold $98.97 million of refunding Metropolitan District bonds, to BofA, with 5s of 2/2025 at 3.12%, 5s of 2029 at 2.86%, 5s of 2034 at 2.93%, 5s of 2039 at 3.24%, 5s of 2044 at 3.60% and 5s of 2045 at 3.64%, callable 8/1/2034.

The county sold $124.215 million of refunding consolidated public improvement bonds, to BofA, with 5s of 2/2025 at 3.12%, 5s of 2029 at 2.86%, 5s of 2034 at 2.93% and 5s of 2035 at 2.97%, callable 8/1/2034.

Frisco, Texas, (Aaa/AAA//) sold $102.31 million of GO refunding and improvement bonds, to Morgan Stanley, with 5s of 2/2025 at 3.22%, 5s of 2029 at 3.05%, 5s of 2034 at 3.08%, 5s of 2039 at 3.37% and 4.125s of 2044 at 4.17%, callable 2/15/2034.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 3.04% (-3) and 3.02% (unch) in two years. The five-year was at 2.86% (unch), the 10-year at 2.85% (unch) and the 30-year at 3.73% (unch) at 3 p.m.

The ICE AAA yield curve was bumped one to seven basis points: 3.08% (-7) in 2025 and 3.03% (-3) in 2026. The five-year was at 2.86% (-2), the 10-year was at 2.85% (-1) and the 30-year was at 3.69% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 3.11% (-1) in 2025 and 3.06% (-1) in 2026. The five-year was at 2.88% (unch), the 10-year was at 2.86% (unch) and the 30-year yield was at 3.70% (unch) at 3 p.m.

Bloomberg BVAL was little changed: 3.12% (-1) in 2025 and 3.07% (-1) in 2026. The five-year at 2.91% (unch), the 10-year at 2.82% (unch) and the 30-year at 3.73% (unch) at 3:30 p.m.

Treasuries were slightly weaker.

The two-year UST was yielding 4.622% (flat), the three-year was at 4.404% (+1), the five-year at 4.242% (+1), the 10-year at 4.295% (+2), the 20-year at 4.592% (+2) and the 30-year at 4.488% (+3) at 3:45 p.m.

Primary to come

Harris County, Texas, (Aaa//AAA/) is set to price this week $731.13 million, consisting of $100.505 million of permanent improvement refunding bonds, Series 2024A; $219.86 million of unlimited tax road refunding bonds, Series 2024A; and $410.765 million of permanent improvement tax and revenue certificates of obligations, Series 2024. Morgan Stanley.

Houston is set to price Thursday a

The Health and Educational Facilities Board of the Metropolitan Government of Nashville and Davidson County, Tennessee, is set to price Wednesday $313.595 million of fixed-rate mode Vanderbilt University educational facilities revenue refunding and improvement bonds, Series 2024. RBC Capital Markets.

The University of Wisconsin Hospitals and Clinics Authority (Aa3/AA-//) is set to price Wednesday $301.425 million of sustainability revenue bonds, consisting of $187.835 million of Series 2024A and $113.59 million of Series 2024B. J.P. Morgan.

The Cedar Hill Independent School District, Texas, (Aaa/AAA/AAA/) is set to price Wednesday $277.695 million of PSF-insured unlimited tax school building bonds, Series 2024, serials 2025-2044, term 2049. Siebert Williams Shank.

The District of Columbia Water and Sewer Authority (Aa2/AA+/AA/) is set to price this week $268.795 million of public utility subordinate lien revenue refunding bonds, Series 2024A. Morgan Stanley.

The San Diego Public Facilities Finance Authority (/AA-/AA/) is set to price Wednesday $213.2 million of lease revenue and lease revenue refunding bonds, Series 2024A. J.P. Morgan.

The Cabarrus County Development Corp., North Carolina, (Aa1/AA+/AA+/) is set to price Thursday $204.63 million of limited obligation refunding bonds, Series 2024A, serials 2025-2044. BofA Securities.

The San Diego Unified School District is set to price Wednesday $200 million of tax and revenue anticipation notes, Series A, serial 2025. BofA Securities.

The Development Authority of Fulton County, Georgia, (Aa3/AA-//) is set to price Wednesday $102.82 million of Georgia Tech Curran Street Residence Hall Project facilities revenue bonds, Series 2024, serials 2027-2044, terms 2050, 2056. Wells Fargo.

The Delaware State Housing Authority (Aa1///) is set to price Wednesday $100 million of non-AMT senior single-family mortgage revenue bonds, 2024 Series C. J.P. Morgan

Competitive

The New Hampshire Muni Bond Bank (/AA+//) is set to sell $113.375 million of 2024 Series C bonds, at 10:30 a.m. Wednesday.

The Dormitory Authority of the State of New York is set to sell $411.38 million of state sales tax revenue bonds, Series 2024A, Bidding Group 1, at 10:45 a.m. Wednesday; $418.55 million of state sales tax revenue bonds, Series 2024A, Bidding Group 3, at 11:15 a.m. Wednesday; and $400.53 million of state sales tax revenue bonds, Series 2024A, Bidding Group 3, at 11:45 a.m. Wednesday.