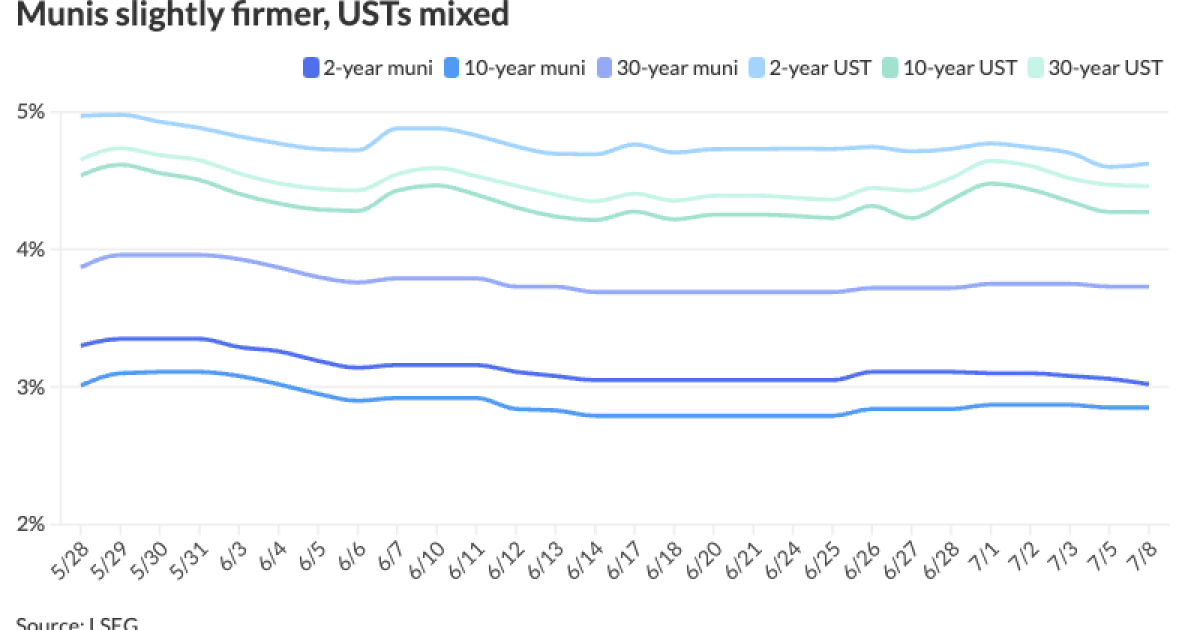

Municipals were firmer Monday ahead of a $9.2 billion new-issue calendar. U.S. Treasuries were little changed and equities ended mixed.

The two-year muni-to-Treasury ratio Monday was at 65%, the three-year at 66%, the five-year at 68%, the 10-year at 67% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 67%, the five-year at 68%, the 10-year at 67% and the 30-year at 83% at 3:30 p.m.

“We expect that favorable July technicals and a stable-to-rallying UST market backdrop should support municipal prices, despite a sizable tax-exempt competitive calendar … heavier-than-typical dealer inventories, and hedge fund selling into the strong summer cash flow,” noted J.P. Morgan strategists, led by Peter DeGroot, in a morning market note.

Competitive deals are slated to total about $2.9 billion, near the highest weekly level this year, they said.

Of the $2.9 billion, $1.3 billion comes from the Dormitory Authority of the State of New York in three series.

“This could be a drag on an otherwise well-funded market, particularly in light of relatively full dealer inventories,” they said.

From a macroeconomic perspective, this week’s calendar highlights the June consumer price index report on Thursday.

“We and consensus are expecting another 0.2% increase in the ex-food and energy core CPI,” they said.

Tuesday, Federal Reserve Board Chair Jerome Powell will present his semiannual monetary policy testimony before the Senate Banking Committee.

Birch Creek Capital noted the muni market underperformed USTs by around 10 to 14 basis points last week.

“That said, the

HY Munis

High-yield muni trade volumes were “quiet” as well last week, but the tone was a “bit more volatile” than in investment-grade munis, Birch Creek strategists said.

The biggest adjustment happened last Monday when UST yields rose nearly 10 basis points, they noted.

“Though there was very little selling pressure from mutual funds, some [exchange-traded fund] redeems caused the market to trade about 10-12bps wider as buyers were reluctant to do much of anything during the holiday week,” Birch Creek strategists said.

The recently issued John F. Kennedy International Airport New Terminal One bonds traded at 4.83%-4.82% last Monday after selling to a customer Friday at 4.74%, they said.

Similarly, Buckeye Tobacco went away at 5.72% compared to Friday’s 5.63%/5.59% market, the strategists said.

“The tone improved each day of the week and by Wednesday, the JFK bid was 4.78% and likely would have seen a full round-trip versus last week if anyone was in on Friday to bid,” they said.

Though UST volatility and political uncertainty have caused HY performance to somewhat “stall out” in the past few weeks, Birch Creek strategists the “stronger trend to pick back up.

High yields saw another week of inflows as LSEG Lipper reported inflows of $215 million, and “the primary calendar shows just a handful of smaller deals slated to price,” Birch Creek strategists said.

“Demand and cash balances still far outweigh supply and selling pressure, so we expect spreads will compress further throughout the summer,” they said.

AAA scales

Refinitiv MMD’s scale was bumped up to four basis points: The one-year was at 3.07% (-3) and 3.02% (-4) in two years. The five-year was at 2.86% (-2), the 10-year at 2.85% (unch) and the 30-year at 3.73% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to three basis points: 3.16% (-1) in 2025 and 3.06% (-3) in 2026. The five-year was at 2.88% (-2), the 10-year was at 2.86% (-1) and the 30-year was at 3.70% (flat) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped one to four basis points: The one-year was at 3.12% (-4) in 2025 and 3.07% (-2) in 2026. The five-year was at 2.88% (-2), the 10-year was at 2.86% (-3) and the 30-year yield was at 3.70% (-1) at 3 p.m.

Bloomberg BVAL was bumped one to three basis points: 3.13% (-3) in 2025 and 3.08% (-3) in 2026. The five-year at 2.91% (-2), the 10-year at 2.82% (-2) and the 30-year at 3.73% (-1) at 3:30 p.m.

Treasuries were little changed.

The two-year UST was yielding 4.623% (+2), the three-year was at 4.399% (+1), the five-year at 4.228% (+1), the 10-year at 4.273% (flat), the 20-year at 4.568% (-1) and the 30-year at 4.460% (-1) at 3:45 p.m.

Primary to come

Harris County, Texas, (Aaa//AAA/) is set to price this week $731.13 million, consisting of $100.505 million of permanent improvement refunding bonds, Series 2024A; $219.86 million of unlimited tax road refunding bonds, Series 2024A; and $410.765 million of permanent improvement tax and revenue certificates of obligations, Series 2024. Morgan Stanley.

Houston is set to price Thursday $720.445 million, consisting of $589.41 million of GO refunding bonds, Series 2024A, and $131.035 million of public improvement refunding bonds, Series 2024B. Ramirez.

The Washington Metropolitan Area Transit Authority (/AA//AA/) is set to price Tuesday

The Health and Educational Facilities Board of the Metropolitan Government of Nashville and Davidson County, Tennessee, is set to price Wednesday $313.595 million of fixed-rate mode Vanderbilt University educational facilities revenue refunding and improvement bonds, Series 2024. RBC Capital Markets.

The University of Wisconsin Hospitals and Clinics Authority (Aa3/AA-//) is set to price Wednesday $301.425 million of sustainability revenue bonds, consisting of $187.835 million of Series 2024A and $113.59 million of Series 2024B. J.P. Morgan.

The Cedar Hill Independent School District, Texas, (Aaa/AAA/AAA/) is set to price Wednesday $277.695 million of PSF-insured unlimited tax school building bonds, Series 2024, serials 2025-2044, term 2049. Siebert Williams Shank.

The District of Columbia Water and Sewer Authority (Aa2/AA+/AA/) is set to price this week $268.795 million of public utility subordinate lien revenue refunding bonds, Series 2024A. Morgan Stanley.

The California Earthquake Authority is set to price Tuesday $250 million of taxable revenue bonds, Series 2024A. J.P. Morgan.

The San Diego Public Facilities Finance Authority (/AA-/AA/) is set to price Wednesday $213.2 million of lease revenue and lease revenue refunding bonds, Series 2024A. J.P. Morgan.

The Cabarrus County Development Corp., North Carolina, (Aa1/AA+/AA+/) is set to price Thursday $204.63 million of limited obligation refunding bonds, Series 2024A, serials 2025-2044. BofA Securities.

The San Diego Unified School District is set to price Wednesday $200 million of tax and revenue anticipation notes, Series A, serial 2025. BofA Securities.

Tallahassee, Florida, (/AA/AA+/) is set to price Tuesday $183.93 million of consolidated utility systems refunding revenue bonds, Series 2024A, serials 2025-2040. BofA Securities.

Honolulu (/AA+/AA+/) is set to price Tuesday $170.15 million of GOs, consisting of $117.6 million of Series 2024A, serial 2025-2049, $18.385 million, Series 2024B, serial 2025-2032, $9.050 million, Series rail, serial 2025-2049, $25.115 million, Series tax, serial 2025-2039. BofA Securities.

The Irvine Ranch Water District, California, (/AAA/AAA/) is set to price Tuesday $165.58 million of refunding bonds, Series 2024A, serials 2025-2040. Goldman Sachs.

The Development Authority of Fulton County, Georgia, (Aa3/AA-//) is set to price Wednesday $102.82 million of Georgia Tech Curran Street Residence Hall Project facilities revenue bonds, Series 2024, serials 2027-2044, terms 2050, 2056. Wells Fargo.

The Delaware State Housing Authority (Aa1///) is set to price Wednesday $100 million of non-AMT senior single-family mortgage revenue bonds, 2024 Series C. J.P. Morgan

Competitive

Baltimore County (Aaa/AAA/AAA/) is set to sell $160 million comprised of $45 million of Metropolitan District bonds, 85th Issue and $115 million of consolidated public improvement bonds, 2024 Series, at 11:15 a.m. Tuesday; and $226.9 million comprised of $102.68 million of refunding Metropolitan District bonds, Series 2024 and $124.22 million of refunding consolidated public improvement bonds, Series 2024, at 10:45 a.m. Tuesday.

Frisco, Texas, (Aaa/AAA//) is set to sell $102.31 million of GO refunding and improvement bonds, Series 2024, at 10:45 a.m. Tuesday; $56.28 million of combination tax and surplus revenue certificates of obligation, Series 2024A, at 11:15 a.m. Tuesday and $9 million of taxable GOs, Series 2024, at 11:45 a.m. Tuesday.

Seattle, Washington, (Aa2/AA//) is set to sell $202.81 million of municipal light and power improvement and refunding revenue bonds, Series 2024, at 10:30 a.m. Tuesday.

Broward, Florida, is set to sell $270 million of tax anticipation notes, Series 2024, at 11 a.m. Tuesday.

The New Hampshire Muni Bond Bank (/AA+//) is set to sell $113.375 million of 2024 Series C bonds, at 10:30 a.m. Wednesday.

The Dormitory Authority of the State of New York is set to sell $430.295 million of state sales tax revenue bonds, Series 2024A, Bidding Group 1, at 10:45 a.m. Wednesday; $437.795 million of state sales tax revenue bonds, Series 2024A, Bidding Group 3, at 11:15 a.m. Wednesday; and $418.95 million of state sales tax revenue bonds, Series 2024A, Bidding Group 3, at 11:45 a.m. Wednesday.

Jessica Lerner contributed to this article.