Municipal bond mutual funds saw small inflows, the secondary market showed constructive trading with firmer prints in spots and the asset class is likely to see slightly positive returns for the month. Equities ended in the black, with the Nasdaq leading the rally.

Triple-A yields were bumped a basis point or two, depending on the curve, while U.S. Treasuries also improved across the curve with the best performance out long.

Municipal to UST ratios were little changed and remain rich at sub-60% 10 years and in.

The two-year muni-to-Treasury ratio Thursday was at 59%, the three-year at 58%, the five-year at 57%, the 10-year at 58% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 58%, the five-year at 57%, the 10-year at 58% and the 30-year at 81% at 3 p.m.

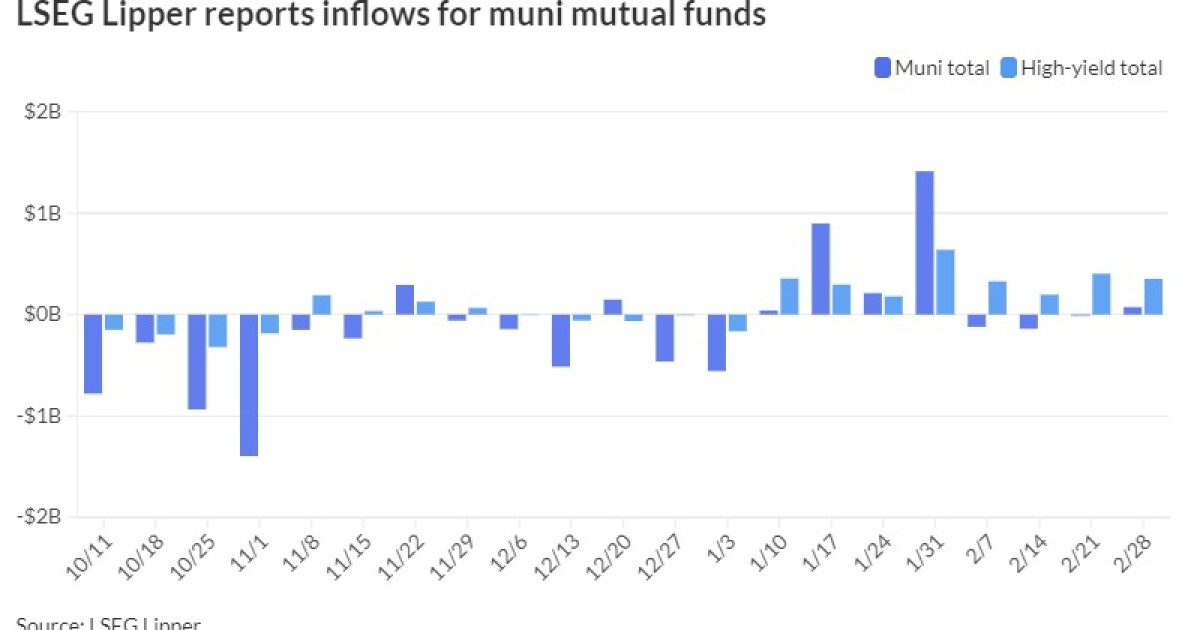

Municipal bond mutual funds saw inflows of $72.3 million for the week ending Wednesday compared to outflows of $4.1 million the prior week, according to LSEG Lipper data. The four-week moving average is at $30.45 million of outflows, down from the prior week’s $312.4 million of inflows.

High-yield bond funds saw inflows of $352.6 million compared to prior week’s $402.6 million of inflows. High-yield inflows have been consistent to start 2024, with the latest marking the eighth consecutive week of inflows.

Municipals look poised to close out February a touch in the black, having a more constructive tone Thursday after being in a “holding pattern” for much of the past two weeks.

“A heavy slate of high grades is coinciding with March’s first round of reinvestments, which for the first installment is estimated at $12 billion by CreditSights,” noted Kim Olsan, senior vice president of trading at FHN Financial. ”Generic yields will finish the month having spent nearly two full weeks in a holding pattern, but both intra- and inter-market dynamics are likely to force some welcome movement.”

February is also looking to close out with much higher issuance year-over-year. Olsan noted net negative supply projections are at negative $9 billion, which is a smaller figure than at mid-month.

Forward supply is growing with The Bond Buyer 30-day visible supply at $8.69 billion, with scheduled pricings including New York City waters, three large Texas issues and $1.2 billion of taxable Chicago-based CommonSpirit Health bonds.

“The upcoming FOMC meeting and economic data ahead of that date could combine with the supply influx to generate a yield reaction along the curve,” Olsan said. ”Late-month activity has left no shortage of credit sectors from which to choose (except for maybe healthcare where 2024 year-to-date supply is actually up 120% from last year), so the focus has been on what areas offers the best concession and relative values.”

AAA scales

Refinitiv MMD’s scale was bumped two to four in spots: The one-year was at 2.98% (unch) and 2.74% (unch) in two years. The five-year was at 2.44% (unch), the 10-year at 2.46% (unch) and the 30-year at 3.59% (unch) at 3 p.m.

The ICE AAA yield curve was little changed: 2.98% (unch) in 2025 and 2.77% (unch) in 2026. The five-year was at 2.45% (-1), the 10-year was at 2.47% (-1) and the 30-year was at 3.56% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.95% (unch) in 2025 and 2.73% (unch) in 2026. The five-year was at 2.43% (unch), the 10-year was at 2.46% (unch) and the 30-year yield was at 3.56% (unch), according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.95% in 2025 and 2.80% in 2026. The five-year at 2.45%, the 10-year at 2.52% and the 30-year at 3.65% at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.629% (-2), the three-year was at 4.426% (-2), the five-year at 4.25% (-2), the 10-year at 4.244% (-3), the 20-year at 4.501% (-4) and the 30-year at 4.363% (-5) at the close.

Primary on Thursday

Jefferies priced for the Hurst-Euless-Bedford Independent School District, Texas, (/AAA/AAA/) $567.73 million of unlimited tax school building bonds, PSF insured.

| Maturity | Coupon | Yield |

| 8/2026 | 5% | 2.76% |

| 2029 | 5% | 2.59% |

| 2034 | 5% | 2.73% |

| 2050 | 4% | 3.12% |

Hoboken, New Jersey, sold $108.137 million of bond anticipation notes (SP-1+) to BofA Securities, maturing in 3/2025 with a 4% coupon to yield 3.12%.

NYC oversubscribed

New York City officials said its offering of about $1.5 billion of tax-exempt fixed-rate general obligation bonds was around 1.9 times oversubscribed.

The city received more than $699 million of retail orders on Tuesday and $2.2 billion of orders for the institutional pricing on Wednesday. Final yields ranged from 2.64% to 4.25%.

Proceeds will be used to fund capital projects and convert some outstanding floating-rate bonds to fixed-rates.

Book-running lead manager BofA Securities priced the GOs with J.P. Morgan, Jefferies, Loop Capital Markets, Ramirez & Co., RBC Capital Markets, Siebert Williams Shank and Wells Fargo Securities as co-senior managers.