Municipals saw some weakness in spots Thursday as outflows from muni mutual funds continued. U.S. Treasury yields rose and equities sold off ahead of Fed Chairman Jerome Powell’s Friday Jackson Hole speech.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 65%, the five-year at 67%, the 10-year at 70% and the 30-year at 91%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 65%, the three-year at 67%, the five-year at 66%, the 10-year at 69% and the 30-year at 91% at 4 p.m.

The massive Treasury swings over the past two to three weeks have put pressure on the muni sector as evident in higher yields, said Nisha Patel, managing director and SMA portfolio manager at Parametric.

While munis were little changed for the second trading session Thursday, triple-A yields are seeing levels not seen in a very long time.

Over the past 15 years, five-year muni yields have only been higher 3% of the time than where they stand currently, while 10- and 20-year muni yields have only been higher 14% and 22% of the time, respectively, Patel said.

Munis were steady in most parts of the curve Thursday after being stopped in their tracks Wednesday “with a substantial UST rally that offered no hedge relief to paring current positions,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

Outside of isolated maturities with nominal price changes, she said the entire curve was essentially flat from Tuesday’s trading session.

As a result, relative values were little changed with the 10-year MMD-UST ratio was at 70%, which is within 2% of the high it achieved in late May, she said.

“Whether that level can be sustained remains suspect with heightened volatility in UST trading (the 10-year range just in one’s week time is 15 basis points),” she said.

Olsan said “the message is that munis are slightly less rich and generic yields are well higher — a combination that should spur sidelined money off the bench.”

Without the benefit of any large-scale new issues, she said “secondary levels were left to their own vices to determine what spread adjustments were needed.”

“Scalable benchmark trades were few and far between as the majority of block-sized bids wanteds comprised short-optioned structures,” she said.

In that category, Olsan said “spreads to call dates have widened to +30 or more against comparable noncallable bonds and at meaningful raw yields.”

“Longer-call bonds show the reality of a buyer’s driven market — a bids wanteds in $2.7 million Hennepin County MN GO 5s due 2034/callable 2031 traded at 3.16% and were sold at 3.12%, a bit wider than where the county’s new-issue 2034 maturity sold,” she said.

A trade of $2.7 million Alabama Public School 5s due 2039/callable 2030 “which were stocked at 3.76% came with a spread of +27/MMD and a 90%/UST ratio,” she said.

Negotiated business of scale “came with two New York issues, each with yields catapulting long maturity TEYs into the 7%+ range,” she said.

The $1 billion New York City’s Transitional Finance Authority issue “offered a 2033 maturity at 3.04% (in-state top bracket TEY 5.37%) and a 5% due in 2048 yielded 4.35% (top bracket TEY 8.20%),” she said.

With New York supply down 40% year-over-year, she said in-state buyers are “benefiting from the rate backup with hefty tax advantages.”

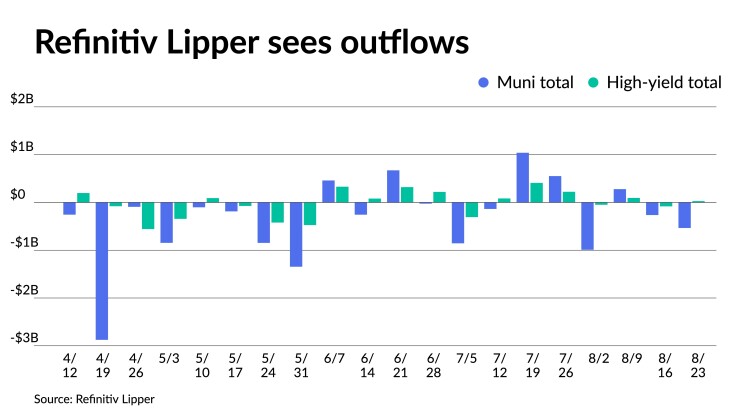

Refinitiv Lipper reported $534.428 million of outflows from municipal bond mutual funds for the week ending Wednesday after $264.046 million of outflows into the funds the previous week.

Year-to-date, outflows are at $8.02 billion, according to Refinitiv Lipper.

“This is still pretty shocking that we weren’t able to recoup a lot of that, especially during the June-July period,” Patel said. “But again, Treasuries moves have also dampened some of that.”

Supply continues to be down from 2023. The first half of the year saw issuance fall 17.1% year-over-year. Bond Buyer 30-day visible supply sits at $4.97 billion.

However, the drop in supply is providing good support for the muni market despite recent outflows.

If supply picks up and “you continue to see some outflows, or at least some pressure from more selling happening or just lower demand, you can now have two factors in technicals, that are providing a little bit more of a weaker environment for municipal bonds, versus what we’re seeing right now,” Patel said.

In the primary market Thursday, Wells Fargo Bank priced for the California Infrastructure and Economic Development Bank (Aa2///) $126.665 million of Academy of Motion Picture Arts and Sciences Obligated Group revenue refunding bonds, Series 2023A, with 5s of 11/2024 at 3.19%, 5s of 2028 at 2.96%, 5s of 2033 at 3.09%, 5s of 2038 at 3.57% and 4s of 2041 at 4.14%, callable 11/1/2033.

In the competitive, the Metropolitan School District of the Washington Township School Building Corp., Indiana (/AA+//), sold $120 million of unlimited ad valorem property tax first mortgage bonds, to Mesirow Financial, with 5s of 1/2025 at 3.42%, 5s of 1/2028 at 3.25%, 5s of 7/2028 at 3.24%, 5s of 1/2033 at 3.28%, 5s of 7/2033 at 3.30%, 4.25s of 7/2038 at 4.21% and 4.375s of 1/2042 at 4.40%.

The Bellingham School District No. 501, Washington (Aaa///), sold $109.440 million of unlimited tax general obligation and refunding bonds, to Citigroup Global Markets, with 5s of 12/2024 at 3.35%, 5s of 2028 at 3.09%, 5s of 2033 at 3.17%, 5s of 2038 at 3.75% and 5s of 2039 at 3.83%, callable 6/1/2033.

Secondary trading

Knoxville, Tennessee, 5s of 2024 at 3.31% versus 3.34% original on Wednesday. California 5s of 2024 at 3.02% versus 3.00% on 8/16. Plano ISD, Texas, 5s of 2025 at 3.39%.

Connecticut 5s of 2028 at 3.04% versus 2.92% on 8/16. California 5s of 2028 at 2.89% versus 2.93% Wednesday. Maryland 5s of 2029 at 2.98%.

Los Angeles USD 5s of 2030 at 2.73% versus 2.78% Wednesday. New Jersey Educational Facilities Authority 5s of 2031 at 2.80%. DASNY 5s of 2035 at 3.31%-3.32% versus 3.23%-3.22% on 8/17 and 3.23% on 8/4.

Texas Water Development Board 5s of 2047 at 4.13%-4.12%. NYC 5s of 2048 at 4.33% versus 4.14%-4.21% on 8/16 and 4.17% on 8/15.

AAA scales

Refinitiv MMD’s scale was unchanged except for cuts in seven- to nine-years: The one-year was at 3.27% (unch) and 3.19% (unch) in two years. The five-year was at 2.93% (unch), the 10-year at 2.95% (unch) and the 30-year at 3.91% (unch) at 3 p.m.

The ICE AAA yield curve was unchanged: 3.29% in 2024 and 3.23% in 2025. The five-year was at 2.91%, the 10-year was at 2.87% and the 30-year was at 3.89% at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged except for cuts in seven- to nine-years: 3.29% (unch) in 2024 and 3.19% (+1) in 2025. The five-year was at 2.94% (+2), the 10-year was at 2.96% (+3) and the 30-year yield was at 3.90% (+3), according to a 4 p.m. read.

Bloomberg BVAL was cut up to one basis point: 3.27% (unch) in 2024 and 3.18% (unch) in 2025. The five-year at 2.89% (unch), the 10-year at 2.88% (unch) and the 30-year at 3.87% (unch) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.015% (+6), the three-year was at 4.692% (+4), the five-year at 4.403% (-+5), the 10-year at 4.232% (+5), the 20-year at 4.498% (+2) and the 30-year Treasury was yielding 4.298% (+3) near the close.

Mutual fund details

Refinitiv Lipper reported $534.428 million of outflows from municipal bond mutual funds for the week ending Wednesday following $264.046 million of outflows the week prior.

Exchange-traded muni funds reported outflows of $105.005 million versus $63.203 million of outflows in the previous week. Ex-ETFs muni funds saw outflows of $429.422 million after $200.843 million outflows in the prior week.

Long-term muni bond funds had $297.863 million of outflows in the latest week after inflows of $53.095 million in the previous week. Intermediate-term funds had $72.381 million of outflows after $18.771 million of outflows in the prior week.

National funds had outflows of $496.381 million versus $245.765 million of outflows the previous week while high-yield muni funds reported inflows of $28.271 million versus outflows of $81.993 million the week prior.