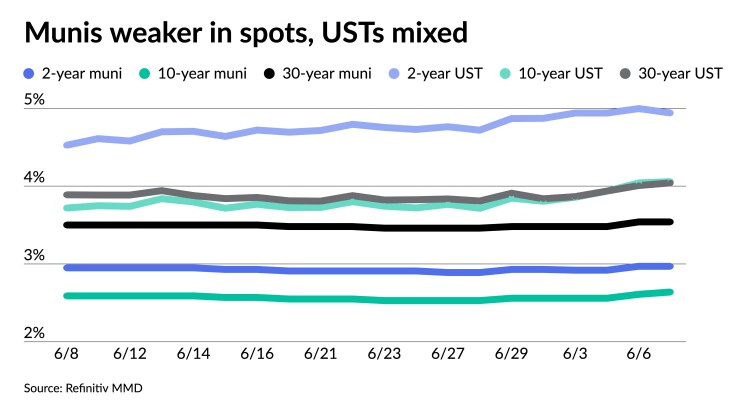

Municipals saw small losses ahead of a larger new-issue calendar, while U.S. Treasuries were stronger up front and weaker out long after the jobs report came in lower than expected, as data continued to send the markets mixed signals on the economy’s health.

Triple-A benchmarks rose up to three basis points, while USTs saw yields fall as much as six basis points on the short end and rise as much as four basis points out long.

The two-year muni-to-Treasury ratio Friday was at 60%, the three-year at 61%, the five-year at 62%, the 10-year at 65% and the 30-year at 88%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 60%, the three-year at 61%, the five-year at 61%, the 10-year at 66% and the 30-year at 90% at 4 p.m.

Activity was quiet in the secondary Friday where trading was relatively slow to close out the holiday-shortened week, according to Bill Walsh, president of Hennion & Walsh, Inc.

But activity was busier than expected throughout the week as yields rose five to 10 basis points out long “due to conflicting jobs reports and questions on whether the Fed will raise rates two more times this year or not,” Walsh said Friday.

“We have seen retail interest at these slightly better levels though, and expect retail demand to remain strong” going forward, he noted.

Economic data, which is somewhat at odds, took the focus this week, according to Jeff Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co

ADP payrolls on Thursday were outsized, surprisingly so, while Friday’s non-farm payrolls report showed a degree of moderation.

“Job formation was less than anticipated, but wages moved higher,” he said. “So on the labor front, it’s a mixed bag.”

Jeffrey Cleveland, chief economist at Payden & Rygel said Friday’s jobs report was solid.

“The bond market is closer to reality now, but still has room for the curve to bear flatten,” he said.

The UST market responded favorably early Friday morning following the release of the jobs report but ended the trading session mixed.

Munis, meanwhile, Lipton said, munis “are steady as she goes.”

Muni yields inside 10 years are relatively rich, while it is closer to fair value farther along the curve outside of 15 years, he said.

Additionally, he said the amount of new-issue supply cannot offset the amount of bond redemptions and maturing securities.

There is still a supply deficit, but he said that deficit over the past week has modestly narrowed. Bond Buyer 30-day visible supply sits at $11.55 billion, while net negative supply is $18.048 billion, according to Bloomberg.

Next week will see a rebound in supply as investors will be greeted with a $7.3 billion new-issue calendar. However, Lipton said issuance will slow once more at the next Federal Open Market Committee meeting in late July.

“As we get closer to the meeting dates, it’s probably a safe bet that we’re going to see a moderation in issuance activity,” Lipton said. “Issuers tend to take to the sidelines, just ahead of an FOMC meeting, given all of the associated uncertainty.”

The expectation is the Fed will hike rates 25 basis points at its July meeting after skipping a rate hike in June.

Across the fixed-income spectrum, many are seeing negative returns. Munis are outperforming both Treasuries and corporates month-to-date, and some of that can be attributed to the supply-demand imbalance seen in the summer months.

He believes munis as an asset class “remain well poised to reveal better performance in the second half of the year with a likely outperformance relative to Treasuries.”

Lipton also thinks munis “stand in good shape to end the year with positive returns,” most likely modest single-digit returns.

Calendar stands at $7.3B

For the coming week, investors will be greeted with a new-issue calendar estimated at $7.282 billion.

There are $5.549 billion of negotiated deals on tap and $1.733 billion on the competitive calendar.

The negotiated calendar is led by $970 million of unlimited tax school building bonds from the Denton Independent School District, Texas, followed by $503 million of tax-exempt power supply revenue bonds from the Intermountain Power Agency and $500 million of taxable corporate CUSIPs from the University of Southern California.

Seattle leads the competitive calendar with $275 million of municipal light and power improvement and refunding revenue bonds, followed by $200 million of tax anticipation notes from Broward County School District, Florida.

Secondary trading

Louduon County, Virginia, 5s of 2024 at 3.09%. Washington 5s of 2025 at 3.03%-3.01%. Connecticut 5s of 2025 at 3.04%-3.01% versus 3.10% Thursday.

DC 5s of 2028 at 2.69% versus 2.69% Wednesday. Wisconsin DOT 5s of 2028 at 2.76%. Alexandria, Virginia, 5s of 2029 at 2.67%.

Washington 5s of 2032 at 2.74% versus 2.71% Thursday and 2.61% Wednesday. Triborough Bridge and Tunnel Authority 5s of 2033 at 2.90%-2.92% versus 2.85%-2.90% Thursday and 2.84%-2.86% Wednesday. Wisconsin 5s of 2034 at 2.77% versus 2.67%-2.66% on 6/21.

Massachusetts 5s of 2053 at 3.92%-3.93% versus 3.90%-3.92%. Indiana Finance Authority 5s of 2053 at 4.19%-4.20% versus 4.13% Thursday and 4.07%-4.09% Wednesday.

AAA scales

Refinitiv MMD’s scale was cut up to three basis points: The one-year was at 3.09% (unch) and 2.97% (unch) in two years. The five-year was at 2.67% (unch), the 10-year at 2.64% (+3) and the 30-year at 3.54% (unch) at 3 p.m.

The ICE AAA yield curve was cut up to three basis points: 3.07% (flat) in 2024 and 3.00% (+1) in 2025. The five-year was at 2.67% (+2), the 10-year was at 2.63% (+3) and the 30-year was at 3.62% (+2) at 4 p.m.

The IHS Markit municipal curve was cut up to three basis points: 3.09% (unch) in 2024 and 2.98% (unch) in 2025. The five-year was at 2.67% (unch), the 10-year was at 2.64% (+3) and the 30-year yield was at 3.54% (unch), according to a 3 p.m. read.

Bloomberg BVAL was cut one to two basis points: 3.05% (+2) in 2024 and 2.95% (+1) in 2025. The five-year at 2.66% (+2), the 10-year at 2.60% (+2) and the 30-year at 3.57% (+2) at 4 p.m.

Treasuries were mixed.

The two-year UST was yielding 4.940% (-6), the three-year was at 4.656% (-3), the five-year at 4.350% (-1), the 10-year at 4.063% (+2), the 20-year at 4.272% (+3) and the 30-year Treasury was yielding 4.044% (+4) near the close.

Jobs report comes in below expectations

The U.S. economy added 209,000 jobs in June, coming in below economists’ forecasts. The figure is also less than May’s stronger-than-expected addition of 306,000 jobs.

“This is the first time in a while that we are seeing a downward surprise in job growth relative to consensus,” said Olu Sonola, head of U.S. Regional Economics at Fitch Ratings.

While this is “a moderation in job growth,” it is still strong compared to pre-pandemic averages, he said.

Job growth in the “catch-up sectors of healthcare and government continues the recent trend of contributing disproportionately to total payroll growth,” Sonola said, while “labor supply seems to have hit a ceiling as the unemployment rate ticked down marginally.”

However, the “monthly increase does not quite match the surge in alternative data published by private payroll processor ADP,” said Mickey Levy and Mahmoud Abu Ghzalah of Berenberg Capital Markets.

Despite this, they noted, “the details of the June employment report are consistent with a resilient labor market that is beginning to cool, albeit gradually.”

“While the most recent job openings number did show signs that labor demand is cooling, the totality of recent data-flow continues to be solid,” Sonola said.

Details of the household survey “were generally positive and point to continued marginal improvements in labor supply,” Levy and Ghzalah noted.

Friday’s jobs report “suggests the U.S. labor market may be showing some — albeit small — signs of softening,” said Sean Snaith, the director of the University of Central Florida’s Institute for Economic Forecasting.

“June’s headline payroll numbers gave a whiff of weakening,” he said. “But the labor market remains strong.”

While “job growth came in a touch under consensus,” Wells Fargo Investment Institute senior global market strategist Sameer Samana said that June jobs report “shows that the labor market remains resilient.”

He noted that “faster-than-expected wage growth and a longer workweek suggest additional tightness.”

“A softer jobs report than widely expected has taken some of the steam out of recent market moves, but the labor market remains too tight for the Fed to relax,” said James Knightley, ING chief international economist. “A July rate hike is coming, but labor data is the most lagging of indicators and softer inflation next week could see rate hike expectations for further out moderate a touch.”

Market participants concurred with Knightley, agreeing that Friday’s jobs report most likely indicates the Fed will hike rates at the July FOMC meeting.

“While the most recent job openings number did show signs that labor demand is cooling, the totality of recent data-flow continues to be solid,” Sonola said. “For the Fed, a rate hike in July is still more likely.”

Snaith said Friday’s numbers “are a near-certain indicator that the Federal Reserve will — and should —raise interest rates again at its July meeting.

“By no means is the Fed’s work done here,” he said. “We’re in a protracted battle against inflation, and nothing in today’s report suggests otherwise.”

Candice Tse, global head of strategic advisory solutions at Goldman Sachs Asset Management, said the lower-than-expected jobs report does not change her belief that the Fed will “continue its hiking cycle this month.”

The U.S. economy, she said, “is still growing below potential, inflation continues to decline, but still remains above the Fed’s 2% target, keeping the Fed on track for another 25 bps hike.”

However, Tse believes “that Fed will soon reach its terminal rate, bringing it closer toward the end of its most aggressive tightening campaign in generations.”

Given “the only gradual easing in labor market tightness in the May JOLTS report and still-healthy employment growth through June, the Fed will likely continue to look for evidence of further softening in labor markets before judging whether policy is restrictive enough,” Levy and Ghzalah said.

Friday’s “employment data together with other signs of economic resilience should keep the Fed firmly on track to raise rates by 25bp at its [July] 25-26 meeting.

Primary to come:

The Denton Independent School District, Texas (/AAA/AAA/), is set to price Tuesday $969.940 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2024-2043, terms 2048, 2053. Piper Sandler & Co.

The Intermountain Power Agency, Utah (Aa3//AA-/), is set to price Tuesday $502.690 of tax-exempt power supply revenue bonds, 2023 Series A. Goldman Sachs.

The University of Southern California (Aa1/AA//) is set to price Tuesday $500 million of taxable corporate CUSIPs, Series 2023. Morgan Stanley.

The Public Utilities Commission of the City and County of San Francisco (Aa2/AA-//) is set to price Tuesday $412.040 million of San Francisco water revenue bonds, consisting of $346.975 million of 2023 Sub-Series A, serials 2028-2043, terms 2048, 2052, and $65.065 million of 2023 Sub-Series B, serials 2028-2043, terms 2048, 2052. Wells Fargo Bank.

The Louisville/Jefferson County Metro Government, Kentucky (/A/A+/), is set to price Tuesday $252.185 million of Norton Healthcare health system refunding revenue bonds, consisting of $145.290 million of Series 2023A and $116.895 million of Series 2023B. J.P. Morgan Securities.

The New Caney Independent School District, Texas (Aaa//AAA/), is set to price Wednesday $223.735 million of PSF-insured unlimited tax school building and refunding bonds, Series 2023. Piper Sandler & Co.

The San Diego Unified School District is set to price Wednesday $200 million of 2023-2024 tax and revenue anticipation notes, Series A, serial 2024. BofA Securities.

The Waxahachie Independent School District, Texas (Aaa//AAA/), is set to price Wednesday $200 million of PSF-insured unlimited tax school building bonds, Series 2023. Jefferies.

Grant County Public Utility District, Washington (/AA/AA/), is set to price Thursday $193.395 million of Priest Rapids Hydroelectric Project revenue and refunding bonds, Series 2023A. J.P. Morgan Securities.

Los Angeles (Aa2//AA/) is set to price Thursday $174.740 million of solid waste resources revenue bonds, Series 2023A. J.P. Morgan Securities.

The Illinois Housing Development Authority (Aaa///) is set to price Monday $160 million of social non-AMT refunding revenue bonds, Series 2023H, serials 2025-2035, terms 2038, 2043, 2048, 2053. Raymond James & Associates.

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price Tuesday $146.940 million of social housing mortgage finance program bonds, Series 2023B, serials 2024-2035, terms 2038, 2043, 2048, 2053. Citigroup Global Markets.

The Garland Independent School District, Texas (Aaa//AAA/), is set to price Monday $144.255 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2024-2045. Raymond James & Associates.

The Michigan State Building Authority(Aa2//AA/) is set to price next week $114.085 million of Facilities Program multi-modal revenue bonds, Series I, term 2058. Barclays.

The Virginia Housing Development Authority (Aa1/AA+//) is set to price Tuesday $110.895 million of non-AMT rental housing bonds, Series 2023D, serials 2026-2035, terms 2038, 2043, 2048, 2053, 2058, 2065. Wells Fargo Bank.

The Chapel Hill Independent School District, Texas (/AAA//), is set to price Thursday $100 million of PSF-insured unlimited tax school building bonds, Series 2023. Piper Sandler & Co.

The New Mexico Mortgage Finance Authority (Aaa///) is set to price Thursday $100 million of tax-exempt non-AMT single-family mortgage program Class I bonds, Series 2023C, serials 2024-2035, terms 2038, 2043, 2048, 2053, 2054. RBC Capital Markets.

Competitive:

Seattle (Aa2/AA//) is set to sell $274.980 million of municipal light and power improvement and refunding revenue bonds, Series 2023A, at 10:45 a.m. eastern Tuesday.

The Broward County School District, Florida, is set to sell $200 million of tax anticipation notes, Series 2023, at 11 a.m. Tuesday.

Frisco, Texas, is set to sell $160.835 million of GO refunding and improvement bonds, Series 2023, at 10:30 a.m. eastern Wednesday.

Newport News, Virginia, is set to sell $101.535 million of GO general improvement bonds, Series 2023A, at 10:45 a.m. Wednesday.

Christine Albano and Christina Baker contributed to this story.